Pay for your Disney+ subscription with Bancontact

From now on, new subscribers of Disney+ in Belgium can purchase their monthly or annual subscription easily, safely and reliably with Bancontact.

An evolution of our brands in 2026

The Payconiq brand will disappear in the course of 2026, and in 2026 our brand identity and brands will undergo a makeover. In the spring of 2026, our company will become ‘Bancontact Company’ and our mobile payment solution will evolve into ‘Bancontact Pay’.

vdk bank integrates Bancontact in its bank app

Bancontact is now fully integrated in the mobile@vdk app, giving vdk bank clients more flexibility and ease with their mobile payments.

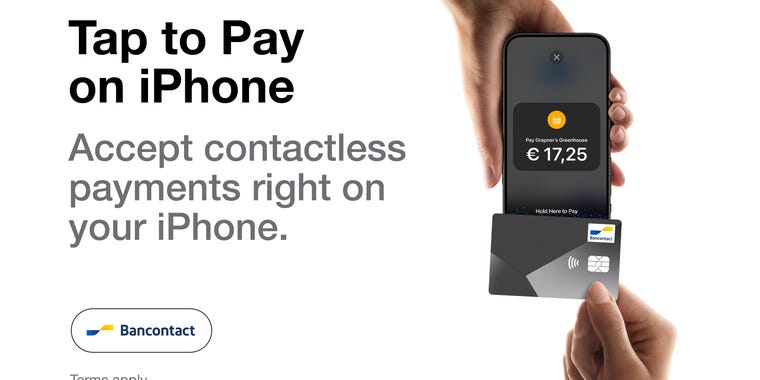

Tap to Pay on iPhone: Accept contactless payments right on your iPhone

With Tap to Pay on iPhone and Bancontact, you can accept all type of in-person contactless payments on your iPhone-no extra terminal or hardware needed.

Bancontact is now available in the Indigo Neo app for one-click and recurring payments

Good news for users of Indigo Neo, the parking app that facilitates on-street and car park parking in the city. From now on, all your parking purchases will be even easier and faster, thanks to the addition of Bancontact as a payment method for one-click and recurring payments.