The smartphone has become our new wallet

Once again this year, the number of mobile payments made with Payconiq and Bancontact continues to climb steeply. Between January and August, Belgians pulled out their smartphones to pay for purchases 37% more often than in the same period last year. The growing popularity of making mobile payments via Payconiq at summer festivals partly explains this success. In August, we paid for the first time over 2 million times by scanning a QR code for our purchases made in-store and at festivals.

Anyone who thought that the rapid growth of mobile payments would slow down after Covid-19 is mistaken. Between January and August 2022, Belgians paid over 171 million times using the Payconiq by Bancontact app or a banking app that incorporates the Bancontact and/or Payconiq mobile payment solutions. That’s an increase of 37%compared with the same period last year, when the number of mobile payments clocked up an already impressive 125 million. Compared with the first wave of Covid-19 (January – August 2020) growth has been even more explosive: in the space of barely two years, we’re now paying 131% more often by mobile.

FESTIVAL SUMMER

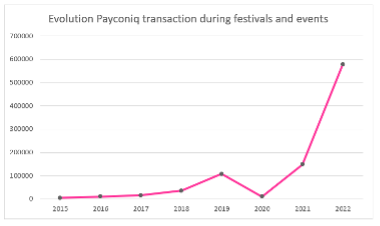

The fact that we enjoyed a real return of festivals in the summer of 2022 certainly has a fair bit to do with this increase. In 2022, QR codes were to be found everywhere at nearly 60 festivals and summer bars (compared with just 9 in 2017). And festival-goers ‘beeped’, in other words paid mobile, more than 578,000 times with the Payconiq by Bancontact app or some other banking app offering Payconiq to pay for their fries or their beer – a multiplication compared with previous years, as the chart below shows.

This year, Belgians also used the Payconiq by Bancontact app or other banking app incorporating Payconiq and/or Bancontact in their droves to pay each other back. From January to August inclusive, there were nearly 28 million payments between friends – a hefty increase of 62% compared with the same period last year (17 million).

CONTACTLESS PAYMENT

In August, 81% of our online purchases were paid for with Bancontact using our smartphone. At the same time, we paid for just 19% of all purchases online using Bancontact via a bank card and card reader. A year ago, this ratio was still at 75% for the app, versus 25% for the card. In 2020 it was 65% and versus 35%, and in August 2019, we paid only 53% of our online purchases mobile versus 47% with the card and card reader. Scanning a QR code is clearly less cumbersome than digging out a card reader and entering your card number manually.

But when we’re in-store, we still like to pay with a bank card – especially if it can be done contactlessly. In August, 61% of all payments with Bancontact in-store were contactless, whereas in August 2021, that figure was still 51%. In the meantime, virtually all Bancontact cards (95% of the 17 million) are now contactless-enabled.

PAYING MOBILE OR “BEEPING”

These days, tapping and beeping have become our favourite ways of paying at the cash register. Because smartphones are also cropping up more frequently as a means of payment in stores. Last month, we registered almost 1.5 million mobile payments at the point of sale using the Payconiq by Bancontact app or a banking app with Payconiq incorporated. That’s a 39% increase compared with August 2021.

The number of merchants offering a Payconiq QR code has also risen sharply. Today, more than 61,000 Belgian merchants accept mobile payments with Payconiq (compared with 45,000 merchants a year ago). All the customer has to do to pay with a smartphone is to scan a Payconiq QR code on a sticker, payment terminal or cash register screen.

CONCLUSION

To sum up, we can safely say that the smartphone has become our new wallet. In the first eight months of this year, 5.3 million Belgians made at least one mobile payment with the Payconiq by Bancontact app or a banking app integrating Bancontact and/or Payconiq payment solutions. Downloading a mobile payment app still continues to gain ground. In the same period (January-August), the Payconiq by Bancontact app was downloaded 1.3 million times – a growth of 10% compared with the same period last year.