For the first time ever, the number of Bancontact and Payconiq electronic payments made in a calendar year exceeds the 2 billion mark

The last week of November saw the 2 billionth electronic payment carried out this year using one of Bancontact Payconiq Company’s methods of payment. The company has never before exceeded the 2 billion mark for electronic payments in the same year. This figure illustrates the fact that an ever increasing numbers of Belgians are making the switch from cash to mobile and card payments. It also shows that payment solutions offered by a local player can be very successful on the Belgian market.

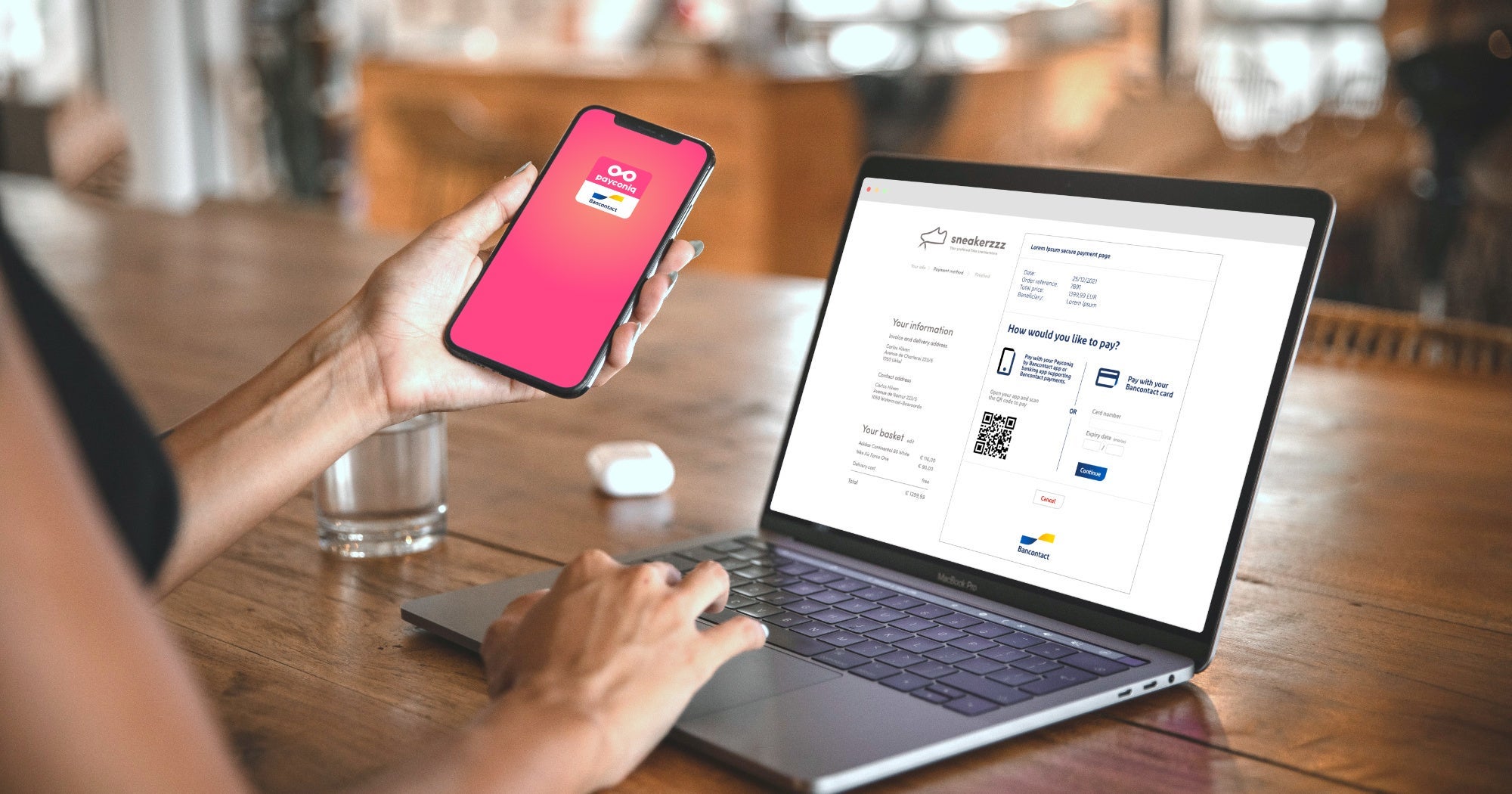

For the first time, Belgians have sailed past the 2 billion electronic payments in the same year mark using Bancontact and Payconiq payment methods. It was in November that Bancontact Payconiq Company recorded the 2 billionth payment made in 2022 with either a Bancontact card, the Payconiq by Bancontact app or a banking app with the mobile Bancontact and/or Payconiq payment solution integrated into it. In 2010, Belgians made 1 billion electronic transactions with Bancontact payments. Today, just 12 years later, that figure has doubled.

Local payment company

The figure of 2 billion tells the extraordinary story of a local payments player that continues to maintain its long-established status as the Belgian’s trusted ‘friend in your pocket’ for making payments. This perception can also be seen clearly from the “Big Bancontact Payconiq Company Payment Survey” that Bancontact Payconiq Company commissions every two years from research firm iVOX, conducted among 1,000 Belgians. The results from the latest survey carried out at the beginning of September show that the majority of Belgians prefer payment apps developed in Belgium to foreign ones. So, 75,3% of all Belgian have a local banking app and/or the Payconiq by Bancontact app on their smartphone. When it comes to foreign payment providers, the percentages are between 5 and 9%.